Internet Banking is an easy way to access your accounts, make payments, do transfers, from home, work or anywhere with internet access using your computer, 24-hours a day, 7-days a week.

Here are just a few of the smart features that give you more choice and control over your finances.

Manage your Money

The Transfer option allows you to easily transfer funds, make payments and manage your beneficiaries

Keep track of your bill payments with Bill Payment History

Manage your Cards

Take control with our simple Credit Card Block Card feature

Even a Debit Card Limit Change is simple and easy to do

Manage your Security

Choose eMail or SMS Alerts on all your financial transactions and security related changes

Enjoy the freedom to Modify your Transaction Limits as and when you need

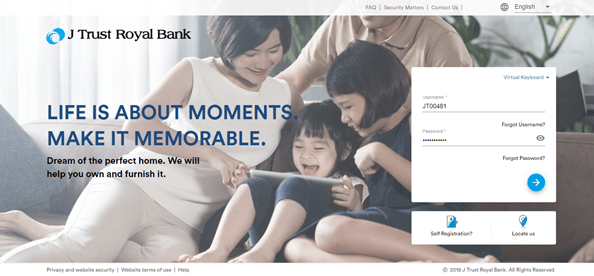

How to Register for Internet Banking

You will need to self-register for Internet Banking before you can login for the first time. To do this, all you need is your mobile number and your ‘Customer ID’. Please make sure your mobile is the same mobile number you provided when you set up your account. Your ‘Customer ID’ would have been provided to you when you opened your account.

If you are unsure about either of these numbers, visit your nearest J Trust Royal Bank branch or call our Customer Care hotline number on 023 999 000.

To self-register:

- Enter your mobile phone number

- Enter the One-time Password (OTP) that is sent to your mobile phone

- Enter your ‘Customer ID’ and ‘Date of Birth’

- Check the Confirmation Screen

- You will be presented with a new ‘Username’

- Enter and confirm your new password

- Note down your new Username (8-digit code) and new password as these will be needed for future log in

- You will then be taken to your Internet banking home page

For more detail on how to register and login, review the First-time Access to JTR Internet Banking Quick Reference Guide.

If you experience any problems self-registering, call our Customer Care hotline number on 023 999 000 or visit your nearest J Trust Royal Bank branch.

Frequently Asked Questions

Internet banking is an easy way to access your accounts, make payments and transfers, from home, work or anywhere with internet access using your laptop 24 hours a day, 7 days a week.

To self-register for Internet Banking you must be a bank customer. You can apply for an account by visiting a J Trust Royal Bank branch or calling our Customer Care hotline number on 023 999 000. To self-register, follow the instructions above.

You can access Internet Banking three ways:

- By clicking on the ‘Internet Banking’ option on the J Trust Royal Bank home page,

- By clicking on the ‘Login’ tab on the top right of the J Trust Royal Bank home page, or

- By inserting this URL jtronline.jtrustroyal.com into your Internet browser.

You can access Internet Banking using any recent Internet browser such as Google Chrome, Internet Explorer and FireFox.

OTP stands for One-Time Password. It is a 6-digit security code that is sent to your registered mobile phone number that you have with the bank. It is an additional level of security to protect you whenever you use Internet Banking. This is a temporary code that will expire 30-secords after you receive it.

You will need to use an OTP for the following:

- When you perform any functional or security level transaction, such as changing a password

- Forgotten and expired passwords

- Forgotten User ID

- Self-registration

- Within bank transaction, domestic transaction and international transaction

- Credit card payment

- Bill payment

- Cheque book request, banker’s cheque request

- Change debit card limit

- Card replacement, block and unblock card

- Modify transaction limit

No. Tokens have been replaced by a one-time password (OTP) sent via SMS to your nominated mobile number. This will give you the same secure access without the need to carry a physical token.

No. You can only receive an OTP to your registered mobile phone.

If you are travelling overseas and you expect to access Internet Banking during this time, it is recommended that you enable international roaming to receive an SMS message.

OTP is a global industry security practice. It is the most secure way to ensure your bank accounts and personal information are protected. It is very important that you keep your log in credentials such as your Customer ID, your Username, your password and OTP confidential. It is recommended that you do not share any of these codes with family members, friends, colleagues or bank staff.

You can contact us by calling our Customer Care hotline open 24/7 on 023 999 000 or by visiting us at your nearest J Trust Royal Bank branch.

For your reference

While all documentation is completed in our branches we also know that it can be helpful to know what to expect before you arrive. Here are the forms and other relevant documents for using J Trust Royal Internet Banking or Mobile App. You don’t need to complete the forms before you come in – our friendly staff are there to help you.

Quick Reference Guides

- Internet Banking And Mobile Banking Terms and Conditions

PDF 279 KB - 1. JTR Internet Banking Self Registration QRG ENG

PDF 986 KB - 2. JTR Internet Banking Login QRG ENG

PDF 694 KB - 3. JTR Internet Banking Home Page QRG ENG

PDF 1.11 MB - 4. JTR Internet Banking Accounts QRG ENG

PDF 945 KB - 5. JTR Internet Banking Deposits QRG ENG

PDF 694 KB - 6. JTR Internet Banking Loans QRG ENG

PDF 670 KB - 7. JTR Internet Banking Debit Cards QRG ENG

PDF 747 KB - 8. JTR Internet Banking Credit Cards QRG ENG

PDF 814 KB - 9. JTR Internet Banking Bill Payments QRG ENG

PDF 627 KB - 10. JTR Internet Banking Transfers QRG= ENG

PDF 968 KB - 11. JTR Internet Banking Settings QRG ENG

PDF 600 KB - 12. JTR Internet Banking Tools QRG ENG

PDF 636 KB - 13. JTR Internet Banking OTP Faqs ENG

PDF 526 KB

Terms and Conditions

Security Matters

At J Trust Royal Bank we are serious about security

All our J Trust Royal Visa Debit Cards have an embedded Enhanced EMV-Dynamic Data Authentication Smart Chip that offers a global standard of security.

We have continuous fraud monitoring systems in place to identify any suspicious activity and help prevent unauthorised transactions. Please keep your contact information with us up-to-date so that we can reach you quickly if suspicious activity is detected.

Our digital banking tools, while simple to use, also incorporate a range of security measures. We manage a security network, use applications from approved vendors with secure coding practices, and conduct regular penetration testing through a third party security firm to protect customers against malware.

Customer Care Centre: +855 (0) 23 999 000

Call us immediately to report lost, stolen or misplaced cards or compromised pin numbers. We can temporarily block or permanently cancel your missing card and organise for a new card to be reissued.